Making Your Miles Count: Choosing a Trucking Company

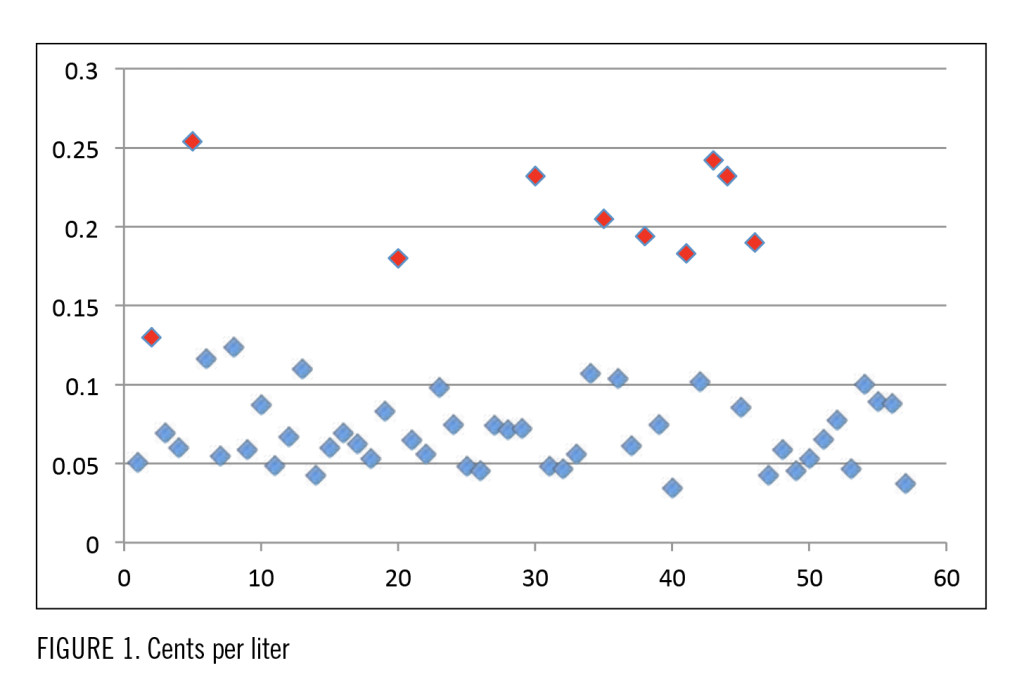

One of the most interesting sections of research for my second book was the charting of fuel taxes. Over 30% of the 260 pages were dedicated to fuel costs. The specific IFTA fuel costs needed to be explored in detail in order to expose high/low cost jurisdictions (I used June 30th 2012 rates/numbers). What I did was chart the cents per liter fuel taxes for every jurisdiction in North America (see figure 1).

The chart shows two colors: red and blue. Blue are the United States jurisdictions and Red is Canadian. The first observation we can see is that Canadians are grossly over taxed. Canadian’s lowest rate (Alberta) is still higher than the United States highest. I’m not exactly sure why we Canadians put up with this type of financial carnage… but we do. Taxes are just one issue that places Canadian trucking at a disadvantage over our US counterparts.

Another major disadvantage is our weather. This of course doesn’t change, regardless of who we elect into office. It also must be said that commercial truck manufacturers do not build trucks for the Canadian winter! In all honesty I’m not sure who really could. Even steel becomes brittle at 40 below zero. Driving in Canada can sometimes be life threatening.

Canada deals with its cold the best it can. However, it becomes expensive. Not only is Canada over taxed from fuel taxes, it must contend with winter fuel issues, specifically gelling. The extreme cold weather causes diesel fuel to gell. In order to minimize the risk of gelling, diesel fuel is “winterized” by thinning it down. The problem with thinning it is the excessive loss of power. Most engines drop about a mile per gallon when the thinned fuel starts pumping.

When clients ask where is the best place to fuel (referring to price), I first comment on the extreme difference between fuel consumption rates. Price is not nearly as important as volume purchased. It is one of the areas where some operators save more than anywhere else. I’m referring to parking the truck in heated locations. However, avoiding winter fuel is still similar to playing Russian roulette. It may not be lethal but it can be an expensive gamble.

Knowing your costs and consumption is critical to the long term success of an operator. It’s one of the reasons when choosing a trucking company, operators must ask themselves (or the carrier) if they will be getting the same consumption rate at the new carrier verses their existing one. Consumption rate has many variables: weight, terrain, equipment, temperature and above all driving habits. Will any of these variables change? Fuel taxes may be a fixed cost per mile (being calculated down to the cent before the truck even leaves the yard) but consumption may and will change nearly every trip.

Making Your Miles Count is the most thorough educational series available to Canadian operators. It is dedicated to operator’s success and the industry’s strength. As the author I’d like to give thanks to Over the Road Magazine for its support of healthy Operators across Canada.

Robert D Scheper operates an accounting and consulting firm in Steinbach, Manitoba. He has a Master’s Degree in Business Administration and is the author of the Book Series “Making Your Miles Count” (taxes, taxes, taxes in 2007) and (Choosing a Trucking Company 2015).

You can find him and his books at www.makingyourmilescount.com or 1-877-987-9787. You can also e-mail him at robert@thrconsulting.ca.

Robert D Scheper operates an accounting and consulting firm in Steinbach, Manitoba. He has a Masters Degree in Business Administration and is the author of the Book “Making Your Miles Count: taxes, taxes, taxes” (now available on CD). You can find him at www.thrconsulting.ca and thrconsulting.blogspot.com or at 1-877-987-9787. You can e-mail him at: robert@thrconsulting.ca.